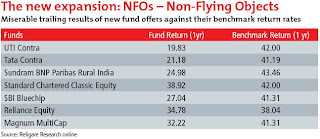

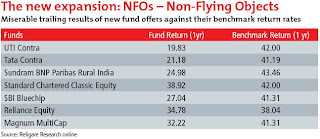

NFOs fail to deliver big-time

Well, the reasons for this tumble are simple – more than the fresh influx of funds, it is the money moving out from the existing funds to the newly launched  New Fund Offers (NFO). Over the past one & half years, the market has been witnessing a bull run with Sensex thundering across the 15,000 milestone; but to the agony of investors, more than 60% of the NFOs have had a trailing record against their benchmarks (the table alongside has startling performance results). UTI Contra, Tata Contra, Sundaram BNP, Stanchart Classic, SBI, Reliance, Magnum, take a name & we’ll show you blood on Dalal Street. Gauri Magar of Arihant Capital Market, puts across her views while speaking to B&E, “They are changing their portfolio on a monthly basis, investors are looking for short term gains & hence you have AUMs eroding, NFOs must be looked as a long term investment...” Easier said than done. If one year is not considered long term, then pray, tell us what else can be?

New Fund Offers (NFO). Over the past one & half years, the market has been witnessing a bull run with Sensex thundering across the 15,000 milestone; but to the agony of investors, more than 60% of the NFOs have had a trailing record against their benchmarks (the table alongside has startling performance results). UTI Contra, Tata Contra, Sundaram BNP, Stanchart Classic, SBI, Reliance, Magnum, take a name & we’ll show you blood on Dalal Street. Gauri Magar of Arihant Capital Market, puts across her views while speaking to B&E, “They are changing their portfolio on a monthly basis, investors are looking for short term gains & hence you have AUMs eroding, NFOs must be looked as a long term investment...” Easier said than done. If one year is not considered long term, then pray, tell us what else can be?

New Fund Offers (NFO). Over the past one & half years, the market has been witnessing a bull run with Sensex thundering across the 15,000 milestone; but to the agony of investors, more than 60% of the NFOs have had a trailing record against their benchmarks (the table alongside has startling performance results). UTI Contra, Tata Contra, Sundaram BNP, Stanchart Classic, SBI, Reliance, Magnum, take a name & we’ll show you blood on Dalal Street. Gauri Magar of Arihant Capital Market, puts across her views while speaking to B&E, “They are changing their portfolio on a monthly basis, investors are looking for short term gains & hence you have AUMs eroding, NFOs must be looked as a long term investment...” Easier said than done. If one year is not considered long term, then pray, tell us what else can be?

New Fund Offers (NFO). Over the past one & half years, the market has been witnessing a bull run with Sensex thundering across the 15,000 milestone; but to the agony of investors, more than 60% of the NFOs have had a trailing record against their benchmarks (the table alongside has startling performance results). UTI Contra, Tata Contra, Sundaram BNP, Stanchart Classic, SBI, Reliance, Magnum, take a name & we’ll show you blood on Dalal Street. Gauri Magar of Arihant Capital Market, puts across her views while speaking to B&E, “They are changing their portfolio on a monthly basis, investors are looking for short term gains & hence you have AUMs eroding, NFOs must be looked as a long term investment...” Easier said than done. If one year is not considered long term, then pray, tell us what else can be? For Complete IIPM Article, Click here

Source: IIPM Editorial, 2008

An IIPM and Management Guru Prof. Arindam Chaudhuri's Initiative

Source: IIPM Editorial, 2008

An IIPM and Management Guru Prof. Arindam Chaudhuri's Initiative

IIPM Arindam Chaudhuri 4Ps Business & Marketing Business & Economy Kkoooljobs Planman Media Planman Consulting Planman Marcom Planman Technologies Planman Financial Planman Motion Pictures GIDF The Daily Indian IIPM Think Tank The Sunday Indian

Labels: Business And Economy IIPM Placements New Delhi, IIPM, MANAGEMENT COURSES IN GURGAON, ranked among top and best colleges

+Limited.JPG)